Point-Of-Sale Systems in India

Point-Of-Sale (POS) is the place where transaction are made. The place where customer purchase be it online or from counter, they are the place where you ring up customers. With the invention of new technologies and business models the redefining Point-Of-Sale Systems are emerging.

Earlier we used to have cash register at the store which were the point of sale, where all details of payment, inventory, and transaction were recorded. But today in digitized world the POS are also digitized. You just need a POS app, internet, and tablet or phone. Whenever a customer does a purchase from your store you scan item or in online store when a customer klick the checkout button. The POS works by calculating the price of the item, updating the inventory showing the item is sold. When the transaction is complete and customer pays using their credit cards, debit card, cash the payment goes through the receipt be it digital or printed in exchange for goods.

Point-of-sale (PoS) systems much more beyond a cash register. Point-of-sale is a handheld device with the biometric reader along with a merchant bank account and internet connectivity. POS machines facilitate acceptance of payment from customers by swiping of their debit/credit/prepaid cards on POS terminals.

A POS system typically contains:

- A display unit to show the billing

- A keyboard/touchscreen device to select products and enter data

- Barcode scanner to scan billed objects

- A Printer to print the receipt

- Cash register – for storage of cash obtained during sales

- A software interface to complete the process

The POS terminal usually performs the following functions.

- Debit/Credit Card Processing

- Receiving Payments

- Making Purchase Receipts

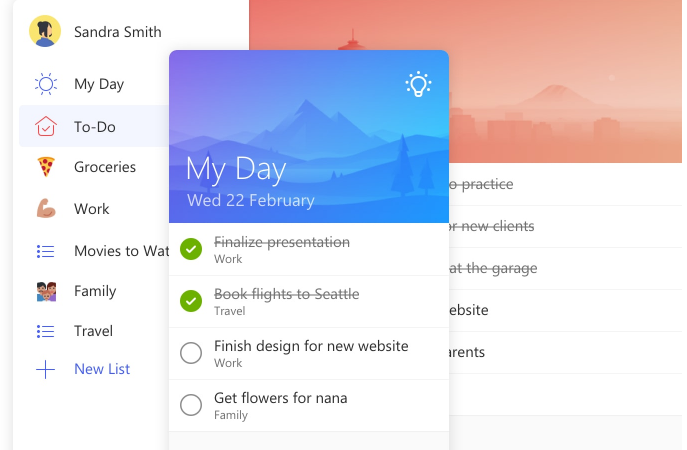

- Creating Inventory

The software is used to run the POS terminal just like our computers run on Windows or Mac or our phones run in iOS or Android we have POS Software to run these POS terminal.

POS Terminal can be a card reading machine or any other device that accepts payment. When you do some purchase in a store you swipe your card on a hardware device. These are terminals build into the system and integrated with POS Software to work with it. The POS terminal will identify the mode of payment and create a recipt after taking the payment. Installing a POS is just setting up the hardware and software in the terminal. The Point Of Sale (POS) Software will provide you with great efficiency as they identify the every product and helps you to handle the checkout faster and efficiently. They will also help you in managing the inventory, you just need to enter the total stock levels and the software adjust inventory levels by itself.

The POS Software can be On-Site system where all the data is saved in local machine. Thye software is installed in the computer system itself. So there is no need of internet and management is responsibility of the trader himself. The POS can be cloud-based system where the data and software is stored at the service provider’s data center. This system will need internet to connect the system and data with the help of web browser.

POS Hardware can be a touch screen device, printer, barcode reader, card machine or a cash register. A businessman should have the basic understanding of the system without which it will be difficult for him to handle it.

Type of PoS in India

Physical PoS

Necessary conditions for service initiation:

- Handheld Device with card and /or bio-metric reader

- Merchant Bank a/c

- Internet connectivity GPRS/ Landline

Service Activation:

- Paper work with Bank for merchant bank a/c

- Deposit certain amount

- Collect device

- Configuration and training to operator

What is required for Transaction:

- Any Card

- Resident for bio-metric authentication (AEPS)

- Assisted Mode

Funds Transfer limit:

- No limit for regulator

- Merchant’s Bank and payee Bank may set limit based on its own discretion

- Disclaimer: The transaction costs are based on available information and may vary based on banks.

Service Available from no. of operators:

- Source RBI – Aug’16

- 14.62 lakh

- Interoperable

Mobile PoS

Necessary conditions for service initiation:

- Smartphone

- App from bank

- Integrated or external card and /or bio-metric reader

- Reader connects using jack or bluetooth

- Internet connectivity 2G/3G/4G, or Wi-Fi

- QR code and Bar code reader

Service Activation:

- Merchant Bank a/c

- Download App

- Register device and/or mobile with merchant bank a/c and bank

- May require training or readable instructions

What is required for Transaction:

- Any Card

- Resident for bio-metric auth (AEPS) for registered devices

- Wallet account

- Scanner for reading QR Code and Bar Code

- Self-service and/or Assisted mode

Funds Transfer limit:

- No limit for regulator

- Merchant’s Bank and payee Bank may set limit based on its own discretion

- Disclaimer: The transaction costs are based on available information and may vary based on banks.

Virtual PoS

Necessary conditions for service initiation:

- Smartphone and /or Web browser

- Internet connectivity 2G/3G/4G, or Wi-Fi or landline

- E-payment gateway

- Virtual A/c for transactions

- May need QR code

Service Activation:

- Merchant Bank a/c with some merchant credentials

- In case of QR code for pull transactions

- May require ability to identify or authenticate user for service delivery

What is required for Transaction:

- Any Card

- Wallet Account

- Scanner for reading QR Code and Bar Code

Funds Transfer limit:

- No limit for regulator

- Merchant’s Bank and payee Bank may set limit based on its own discretion

- Disclaimer: The transaction costs are based on available information and may vary based on banks.

Online POS Software will let you know the real time sales and inventory easily. POS Software comes with features like Lots and Bar code management, Loyalty Management, E-commerce API, Bulk purchase order, Discounts, Accounting and more.

Suggested Read: Top Five Credit Card in India