Fight against Black money – Scrapping larger rupee notes

Demonetization in India, announced on 8 November 2016, was one of the most dramatic economic decisions in the country’s history. That evening, Prime Minister Narendra Modi announced that the existing ₹500 and ₹1,000 notes, which formed nearly 86% of India’s currency in circulation, would no longer be considered legal tender. The move affected every citizen and reshaped the way India handled money, payments, and taxation.

Demonetization: What Was It?

Demonetization refers to the withdrawal of a currency unit’s legal status. In the case of India, the 2016 step involved invalidating the two highest denomination notes in circulation.

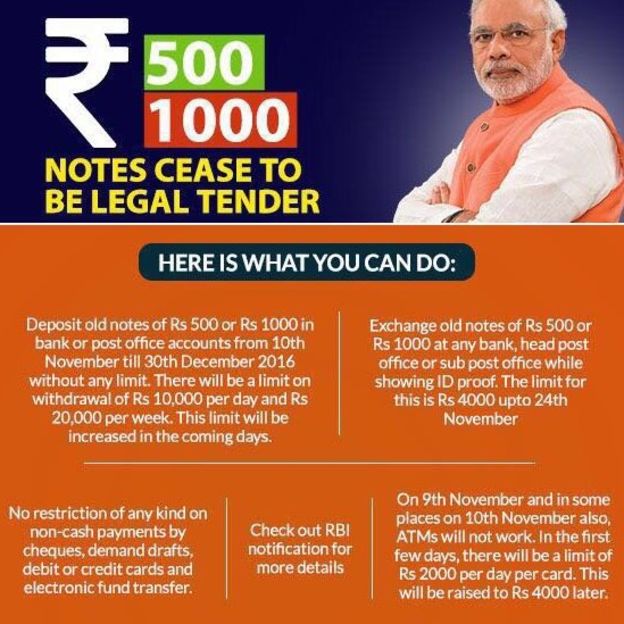

People were given a limited time to:

- Deposit old notes in banks

- Change small amounts to get new notes.

- Provide proof of identity for large deposits.

This resulted in long queues outside banks and ATMs due to a scarcity of cash.

Demonetization Objectives

The government explained four major goals behind the move:

- Curb Black Money

Black money is the income not disclosed to the taxation authorities. The government hoped that demonetization would force those holding unaccounted cash either to disclose it or lose it.

- Combat Fake Currency

These notes of ₹500 and ₹1,000 denomination were further used to fund illicit activities, terrorism financing, and corruption. The need to get rid of old notes was thus an attempt to break this vicious circle.

- Corruption reduction

A cash-driven economy makes corruption easier. By pulling out large notes, the government intended to make cash-based illegal transactions harder.

- Promote a Digital, Cashless Economy

The policy intended to push India towards digital payments in the nature of:

- UPI

- Mobile wallets

- Net banking

- Debit/credit cards

This shift was expected to modernize India’s financial system.

Suggested Read: Indian Rupee